Best Lafayette, Louisiana Auto Insurance in 2025

The average Lafayette, LA auto insurance rates are $481 per month. The minimum auto insurance in Lafayette is at least 15/30/25 in coverage to comply with Louisiana auto insurance laws. To find the best cheap auto insurance in Lafayette, Louisiana, compare quotes from multiple companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

UPDATED: Jan 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Intro Table - Lafayette, Louisiana

| Lafayette City Statistics | |

|---|---|

| Population | 126,848 |

| City Density | 2,665 people per square mile |

| Average Cost of Insurance in City | $5,306.56 |

| Cheapest Car Insurance Companies | State Farm and USAA |

| Road Conditions | Poor share: 40% Mediocre share: 24% Fair share: 16% Good share: 21% |

- The minimum auto insurance required in Lafayette, Louisiana is 15/30/25

- Average auto insurance rates in Lafayette, LA for senior drivers are $3,577 per year

- The most expensive auto insurance company in Lafayette for teen drivers is Progressive

Lafayette, Louisiana auto insurance requirements are 15/30/25 according to Louisiana auto insurance laws. Finding cheap auto insurance in Lafayette can seem like a difficult task, but all of the information you need is right here. We’ll cover factors that affect auto insurance rates in Lafayette, Louisiana, including driving record, credit, commute time, and more.

Compare auto insurance in Lafayette to other Louisiana cities, including Shreveport auto insurance rates, Kenner auto insurance rates, and Baton Rouge auto insurance rates to see how Lafayette, Louisiana auto insurance rates stack up.

Before you buy Lafayette, Louisiana auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Lafayette, Louisiana auto insurance quotes.

Minimum Auto Insurance in Lafayette, Louisiana

Lafayette, Louisiana auto insurance laws require that you have at least the Louisiana minimum auto insurance to be financially responsible in the event of an accident. Take a look at the required auto insurance in Lafayette, Louisiana.

Minimum Required Auto Insurance Coverage in Lafayette, Louisiana

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $15,000 per person $30,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

These minimum requirements don’t cover injury, death, or damage to you or your passengers, which is why you should consider buying more than the required coverage for greater protection.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

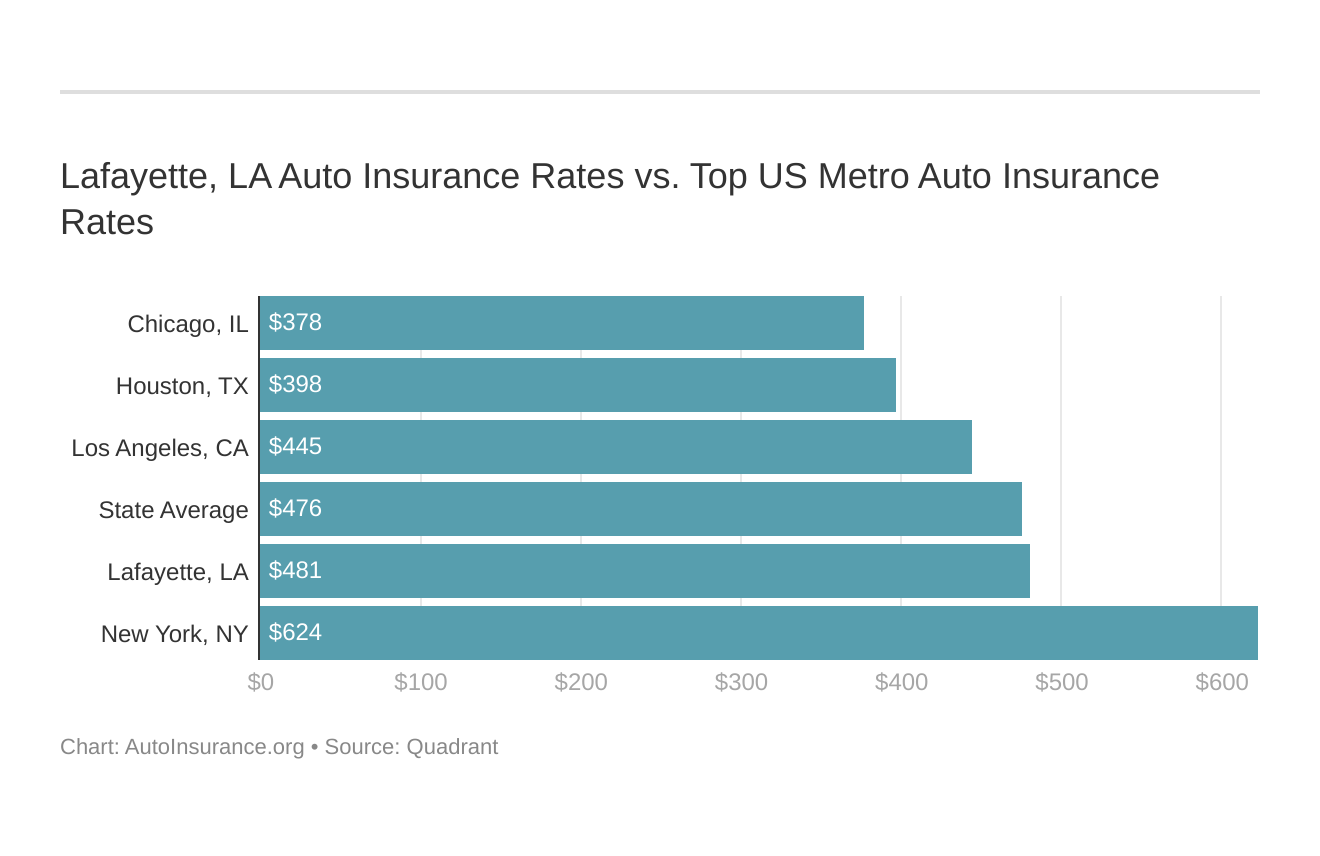

What is the cost of car insurance like in Lafayette?

How much you pay for auto insurance in Lafayette may vary. The average annual cost of an insurance premium there is $5,306.56, which for many residents, isn’t exactly cheap. What is a driver looking for decent car insurance coverage at a reasonable price to do?

You might find yourself asking how does my Lafayette, Louisiana stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

For one thing, you should compare prices and make sure you find out all about the different types of coverages available that will give you the most protection.

Below, we’ll cover some of the biggest factors that go into setting car insurance rates so you can see how much they will affect what you can afford.

To get a true car insurance education, read on.

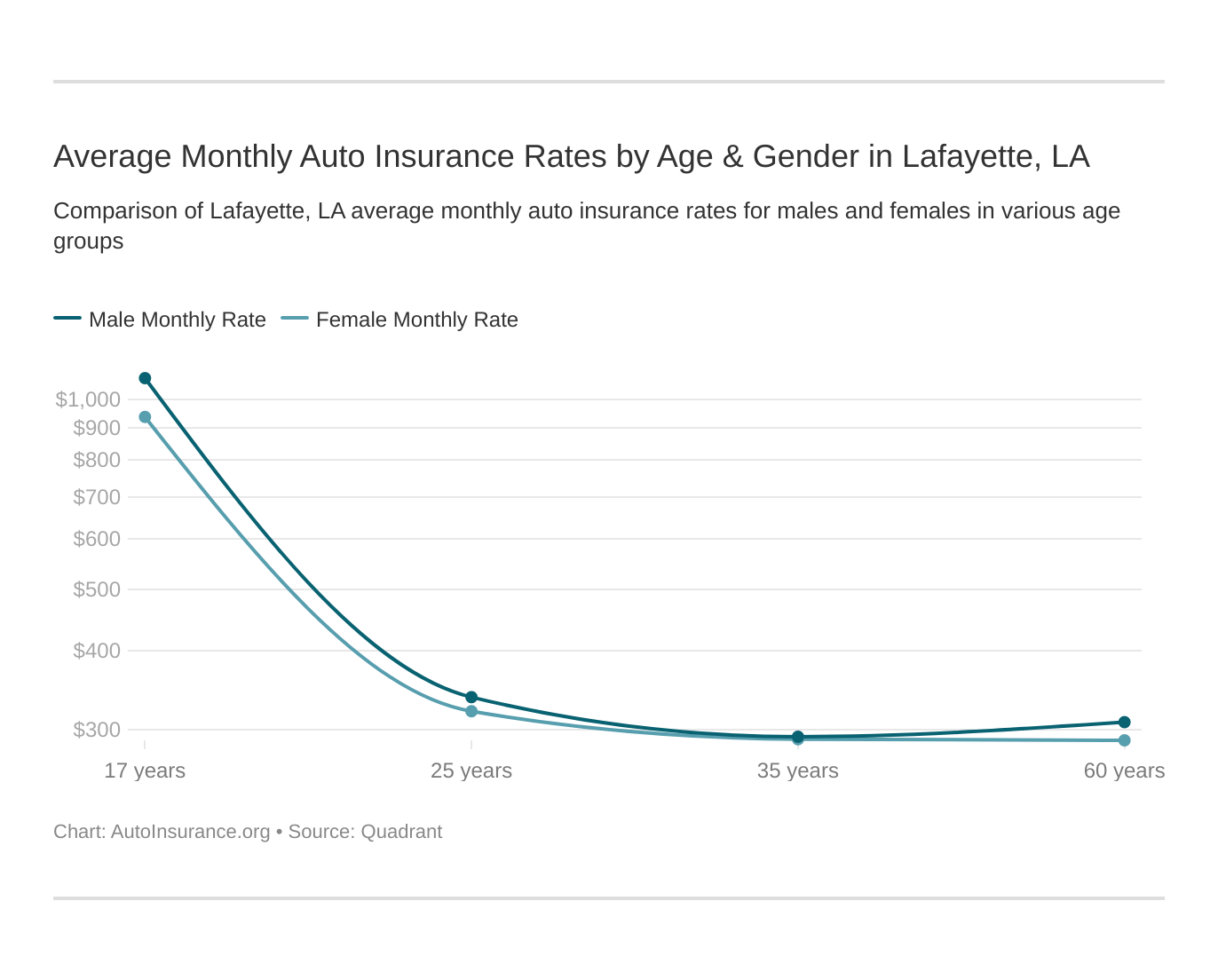

Will age and gender affect what you pay?

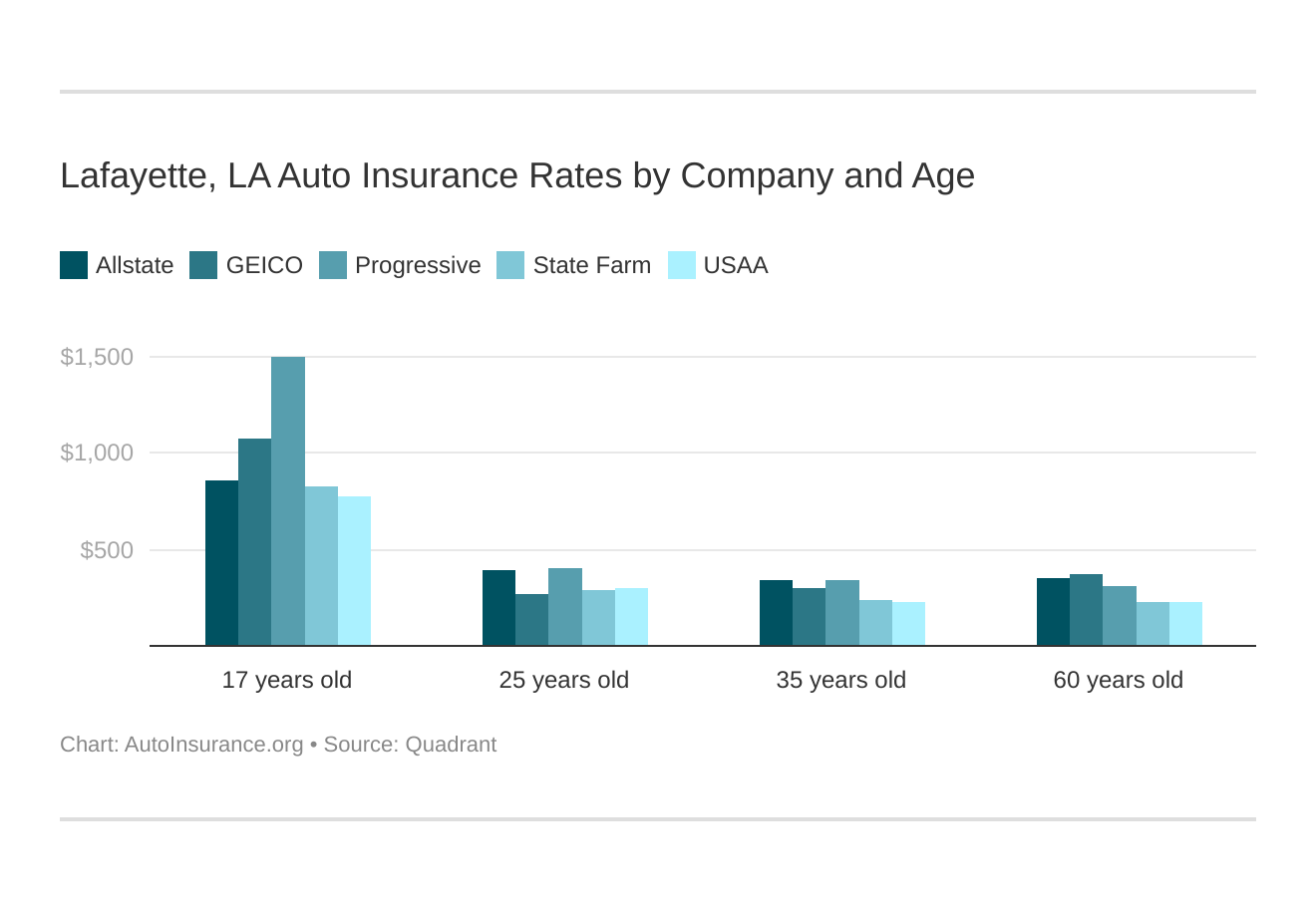

Data USA statistics show the average age of Lafayette residents is 35, which means many drivers there get the lowest rates. Look no further than the chart below for proof:

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. LA does use gender, so check out the average monthly car insurance rates by age and gender in Lafayette, LA.

City & Age - Lafayette, Louisiana

| 35 | 60 | 17 | 25 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|

| $3,488.62 | $3,576.95 | $12,096.16 | $3,946.65 | $3,488.62 | 35 |

Surprisingly, 60-year-olds pay more for car insurance than 35-year-olds in Lafayette, which goes against the average in many other cities. In that regard, Lafayette stands out.

Lafayette, LA car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

In keeping with traditional risk assessments, insurers charge 17-year-old drivers — typically drivers without a lot of experience — the highest rates.

Let’s take a closer look at how your age, gender, and marital status influence your car insurance rates in Lafayette. Next, we’ll explore prices by gender.

Males – $5,777.09

Females – $5,504.79

Females, who are often a lower accident risk, pay lower rates than males. Yet, it’s not a major factor in Lafayette, with a difference of under $300 between the sexes.

We’ll go into more detail about how much both genders’ annual salaries pay for car insurance a little later. For now, here’s how much drivers of different age groups, genders, and marital statuses pay for car insurance in Lafayette:

City & Gender & Age

| Demographic | Rate (Cheapest) |

|---|---|

| Married 60-year-old female | $3,458.52 |

| Married 35-year-old female | $3,472.74 |

| Married 35-year-old male | $3,504.49 |

| Married 60-year-old male | $3,695.38 |

| Single 25-year-old female | $3,845.38 |

| Single 25-year-old male | $4,047.91 |

With less than $20 separating them, married 60-year-old females narrowly edge out their 35-year-old counterparts in paying the lowest rates. Males, especially young and single ones, such as 25-year-olds, pay among the highest premiums.

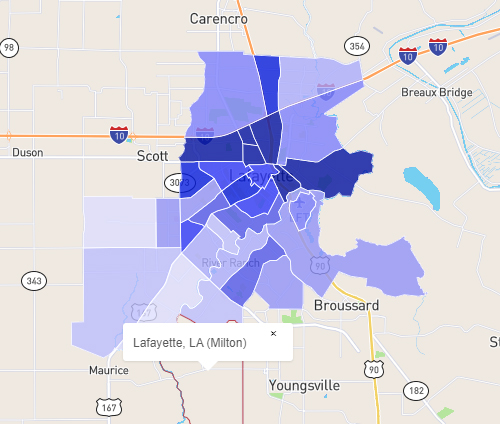

What are the cheapest ZIP codes in Lafayette?

Who pays the lowest and highest-priced car insurance premiums in Lafayette? Look below for some insights.

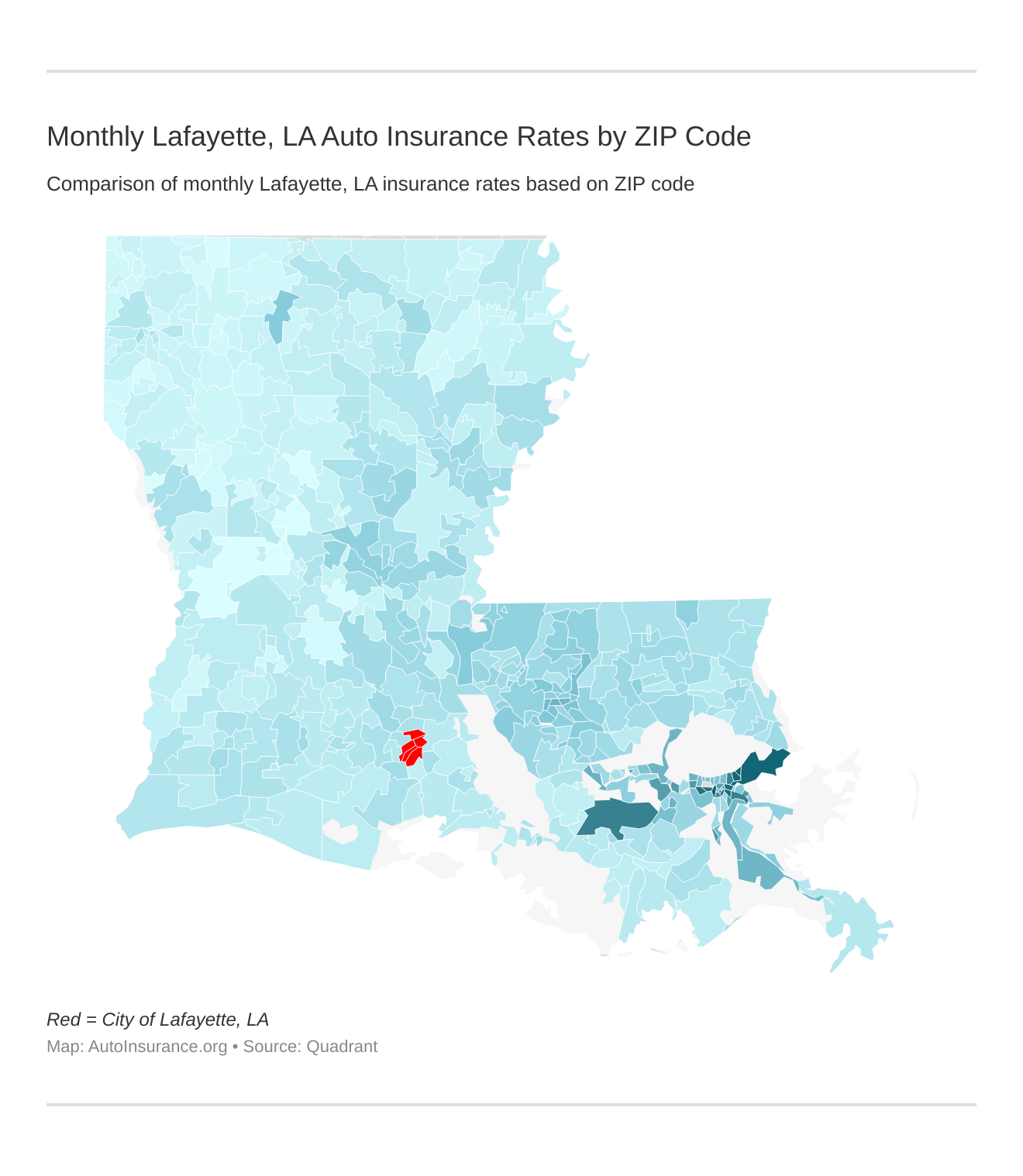

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Lafayette, Louisiana auto insurance rates by ZIP Code below:

Cheapest Zip Code - Lafayette, Louisiana

| City | Zip | Average Annual Rate |

|---|---|---|

| Lafayette | 70501 | $5,543.22 |

| Lafayette | 70503 | $5,418.99 |

| Lafayette | 70504 | $5,327.35 |

| Lafayette | 70506 | $5,423.36 |

| Lafayette | 70507 | $5,306.56 |

| Lafayette | 70508 | $5,381.80 |

| Lafayette | 70583 | $5,409.59 |

Residents of ZIP code 70507 get the cheapest rates, which amount to just over $200 less than those in 70501. The price differences often come down to crime rates and the amount of weather-related claims in different parts of town, which can be helpful to keep in mind if you’re wondering whether your car insurance goes up after moving.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best By Category: Cheapest Auto Insurance in Lafayette, Louisiana

Compare the cheapest auto insurance companies in Lafayette, Louisiana in each category to find the company with the best rates for your personal needs.

Best Annual Auto Insurance Rates by Company in Lafayette, Louisiana

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | State Farm |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | USAA |

What’s the best car insurance company in Lafayette?

The level of customer service a company offers, together with discounts, coverage options, and reviews, can influence which company you consider best.

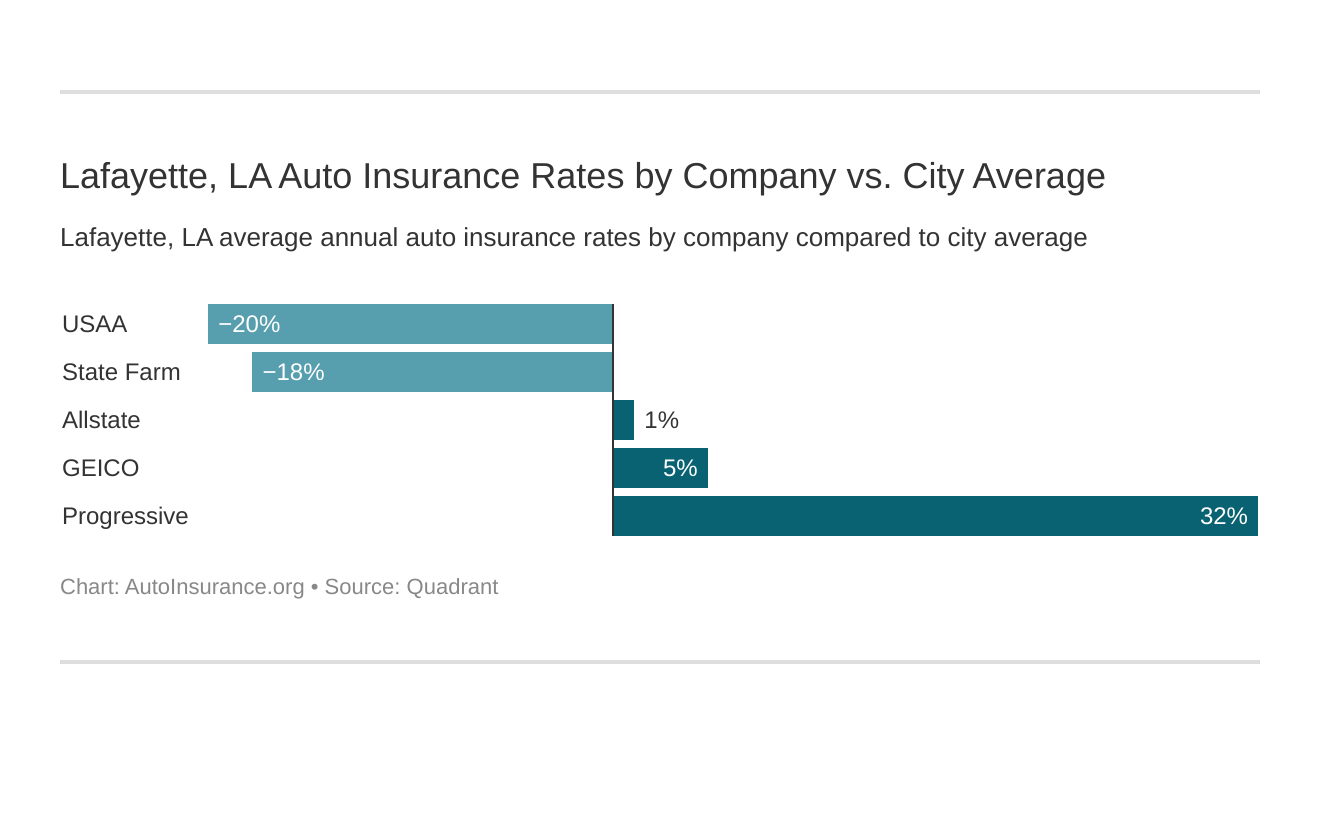

Which Lafayette, LA car insurance company has the best rates? And how do those rates compare against the average Louisiana car insurance company rates? We’ve got the answers below.

Let’s look more closely at factors that can affect your rates and help you find the right car insurance company for your needs.

Cheapest Car Insurance Rates by Company

If you prefer to shop by price, you’ll be most interested in the rates the top insurers offer in Lafayette below.

Cheapest Car Insurance Rates by Company - Lafayette, Louisiana

| Group | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| $4,095.06 | $4,095.06 | $4,255.17 | $4,255.17 | $9,105.22 | $11,479.26 | $4,531.00 | $4,912.85 | $5,841.10 | |

| $3,355.66 | $3,877.00 | $4,049.57 | $4,970.37 | $12,589.21 | $13,225.43 | $3,241.88 | $3,111.01 | $6,052.52 | |

| $4,206.36 | $3,896.97 | $3,539.30 | $3,839.64 | $17,093.20 | $18,949.50 | $4,776.53 | $4,825.33 | $7,640.85 | |

| $2,901.04 | $2,901.04 | $2,690.52 | $2,690.52 | $8,815.14 | $11,034.49 | $3,242.50 | $3,639.43 | $4,739.34 | |

| $2,805.57 | $2,752.40 | $2,758.05 | $2,721.20 | $8,609.92 | $10,060.25 | $3,434.99 | $3,750.93 | $4,611.66 |

USAA and State Farm charge the cheapest rates, while Allstate and Progressive have the highest-priced premiums. Geico’s pricing falls in the middle.

Best Car Insurance for Commute Rates

How far you drive also factors into your car insurance costs. Louisianans drive an average of 14,566 miles annually, which is more or less in line with residents of other states. How far do you drive every year?

The chart below shows how much car insurance rates vary for 10- to 25-mile commutes.

Car Insurance Rates by Commute - Lafayette, Louisiana

| Group | 10-mile commute, 6,000 annual mileage. | 25-mile commute, 12,000 annual mileage. | Average |

|---|---|---|---|

| $5,841.10 | $5,841.10 | $5,841.10 | |

| $5,938.57 | $6,166.46 | $6,052.52 | |

| $7,640.86 | $7,640.86 | $7,640.86 | |

| $4,617.00 | $4,861.68 | $4,739.34 | |

| $4,469.82 | $4,753.51 | $4,611.67 |

Allstate and Progressive don’t change their rates based on mileage, but among those who do, State Farm offered the lowest rates between the two mileages, at just over $250.

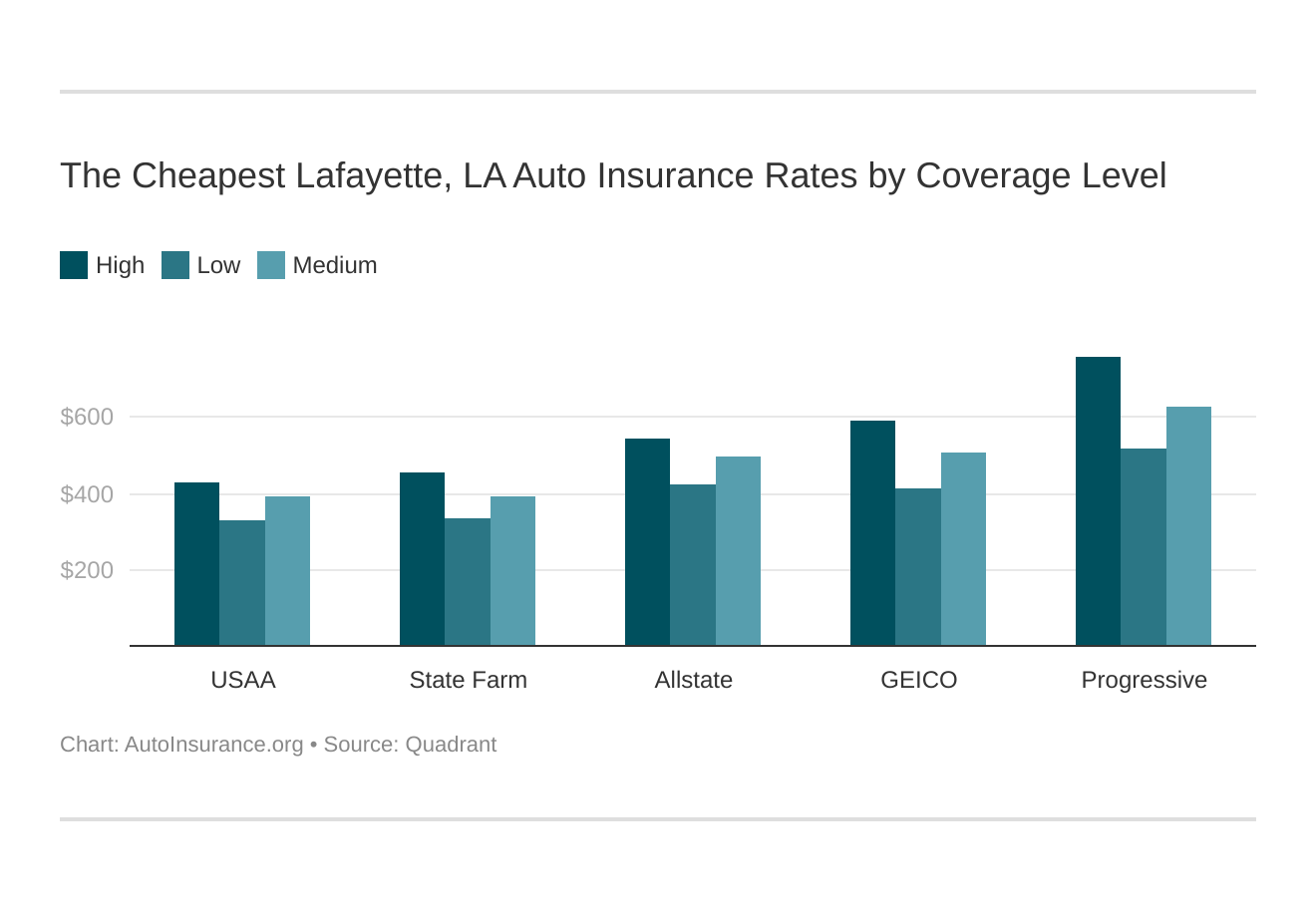

Best Car Insurance for Coverage Level Rates

How much insurance you buy, whether it’s just liability, collision, comprehensive, or full coverage, also affects your rates. The chart below shows average annual prices from the lowest to the highest coverage levels.

Your coverage level will play a major role in your Lafayette car insurance rates. Find the cheapest Lafayette, LA car insurance rates by coverage level below:

Car Insurance Rates by Coverage Level - Lafayette, Louisiana

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| $6,507.37 | $5,064.00 | $5,951.92 | $5,841.10 | |

| $7,110.22 | $4,969.60 | $6,077.72 | $6,052.51 | |

| $9,126.80 | $6,226.61 | $7,569.16 | $7,640.86 | |

| $5,449.39 | $4,041.46 | $4,727.16 | $4,739.34 | |

| $5,178.57 | $3,970.60 | $4,685.82 | $4,611.66 |

Allstate and State Farm had the smallest price spread from the lowest to the highest coverage, which amounted to roughly $1,500.

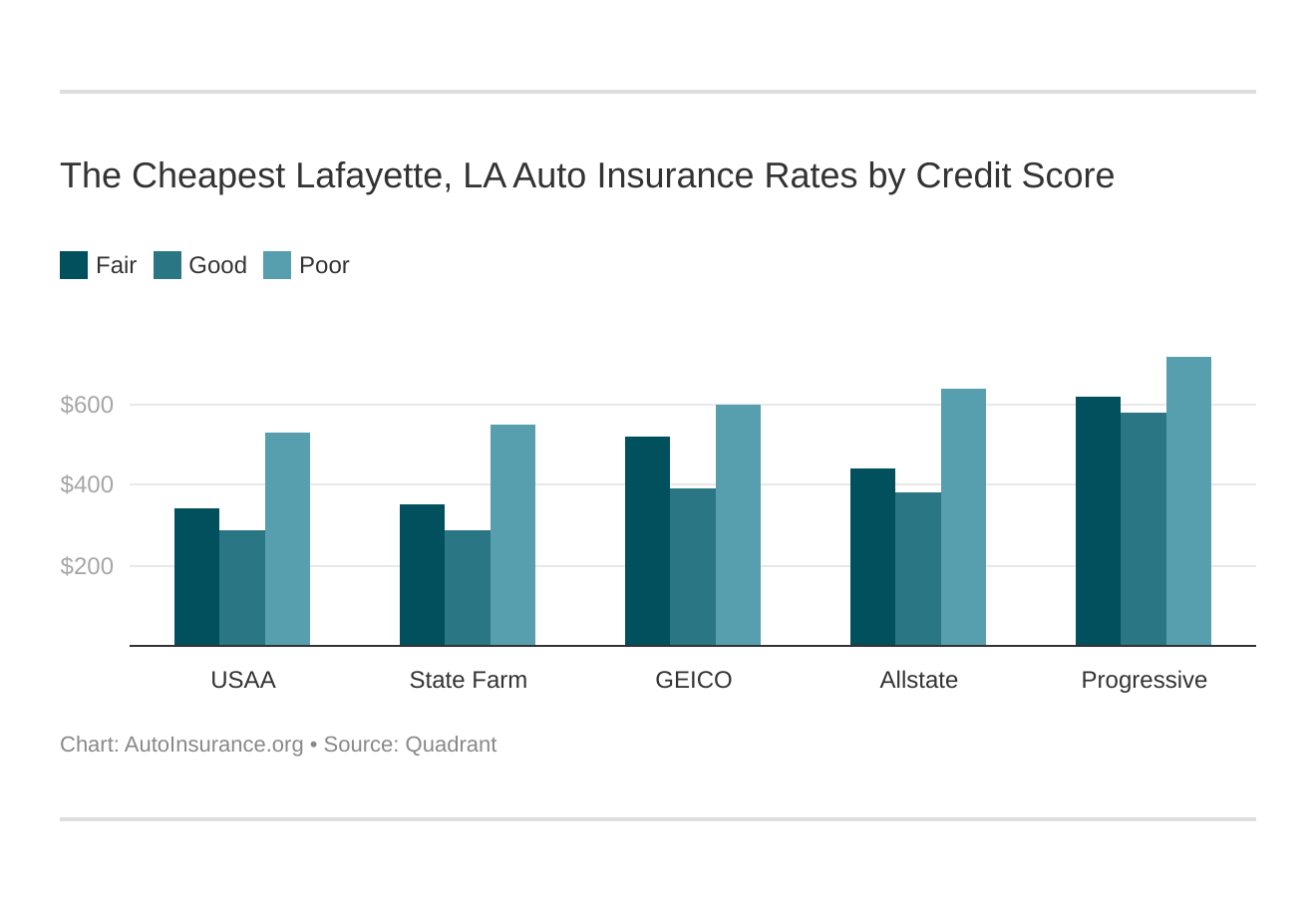

Best Car Insurance for Credit History Rates

Your credit score can have a major impact on your ability to get a job, a mortgage, and decent car insurance rates. Here’s how credit scores affect car insurance rates in Lafayette.

Your credit score will play a significant role in your Lafayette car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Lafayette, LA car insurance rates by credit score below.

Car Insurance Rates by Credit History - Lafayette, Louisiana

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| $5,264.07 | $4,587.91 | $7,671.32 | $5,841.10 | |

| $6,247.89 | $4,709.32 | $7,200.34 | $6,052.52 | |

| $7,411.77 | $6,906.98 | $8,603.82 | $7,640.86 | |

| $4,232.01 | $3,421.90 | $6,564.09 | $4,739.33 | |

| $4,077.09 | $3,410.16 | $6,347.75 | $4,611.67 |

With many of the insurers listed, drivers with a poor credit history may pay from $2,000 to $3,000 more than those with good credit scores.

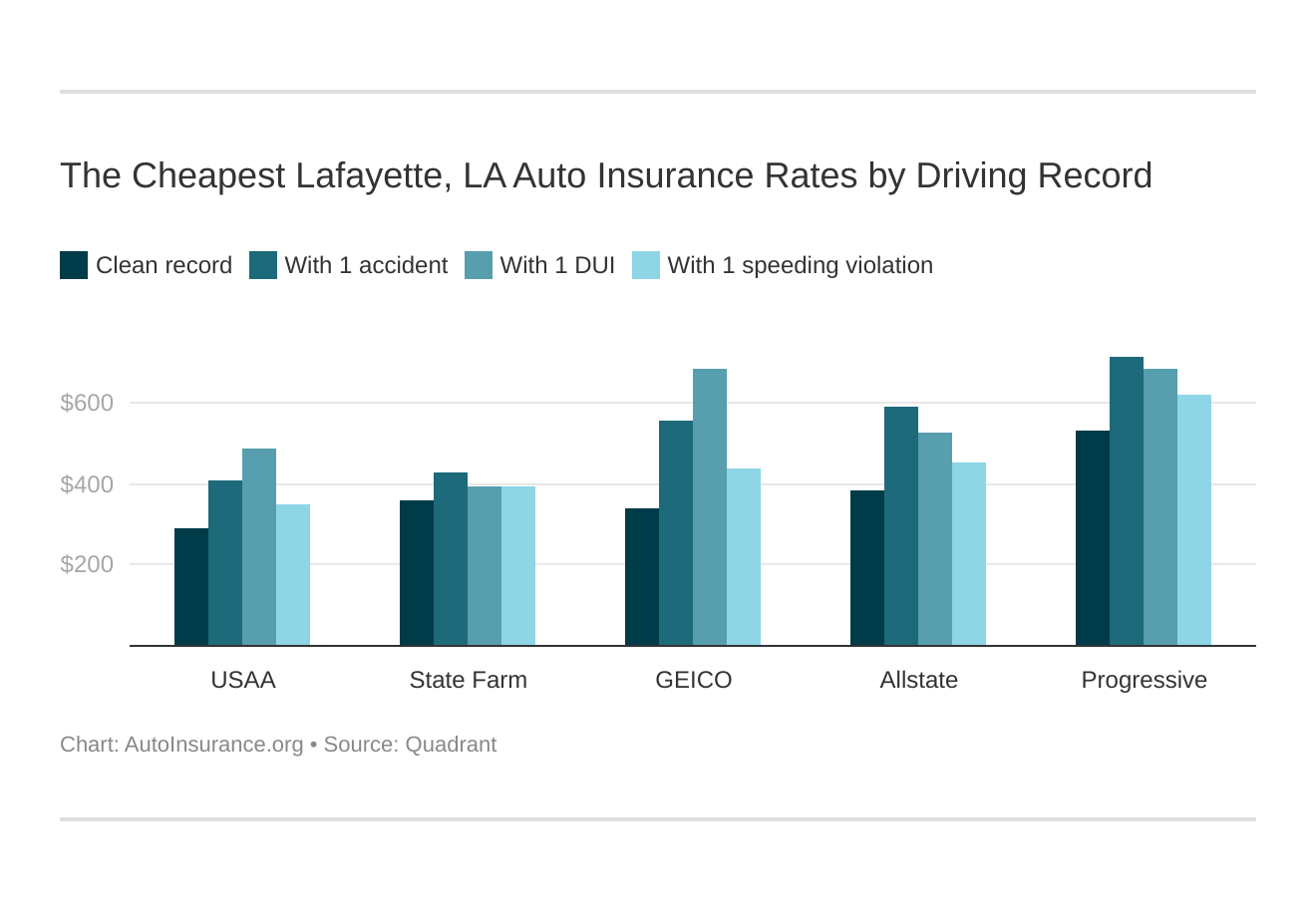

Best Car Insurance for Driving Record Rates

How clean is your driving record for car insurance? If you’ve gotten several violations recently, you’re likely paying more for your car insurance. The table below reveals how rates can change with common driving infractions.

Your driving record will play a major role in your Lafayette car insurance rates. For example, other factors aside, a Lafayette, LA DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Lafayette, LA car insurance rates by driving record.

Car Insurance Rates by Driving Record - Lafayette, Louisiana

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| $4,577.31 | $7,078.61 | $6,298.08 | $5,410.39 | $5,984.67 | |

| $4,088.91 | $6,644.66 | $8,236.53 | $5,239.96 | $6,323.37 | |

| $6,355.43 | $8,571.92 | $8,206.54 | $7,429.53 | $7,711.30 | |

| $4,325.83 | $5,152.84 | $4,739.34 | $4,739.34 | $4,739.34 | |

| $3,511.25 | $4,899.56 | $5,836.72 | $4,199.13 | $4,749.18 |

As shown, even one speeding ticket can lead to premium hikes of several hundred dollars.

How can I get cheap auto insurance in Lafayette?

Distracted driving, high prices for car repairs, and gas prices are among the reasons why car insurance costs rise nationwide.

But did you know that a high amount of stolen vehicles and uninsured drivers — let alone high accident to litigation rates and flooding rates — are to blame for costly premiums in Louisiana?

Generally, the best way to keep your rates low is to drive safely and obey the rules. Clean driving records can work wonders for keeping payments low. Strong credit history can also help, as can the right ZIP code. Don’t forget to look for discounts that can help you save even more. However, don’t sacrifice quality customer service for a better price. You want a strong, dependable company almost as much as you want affordable rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

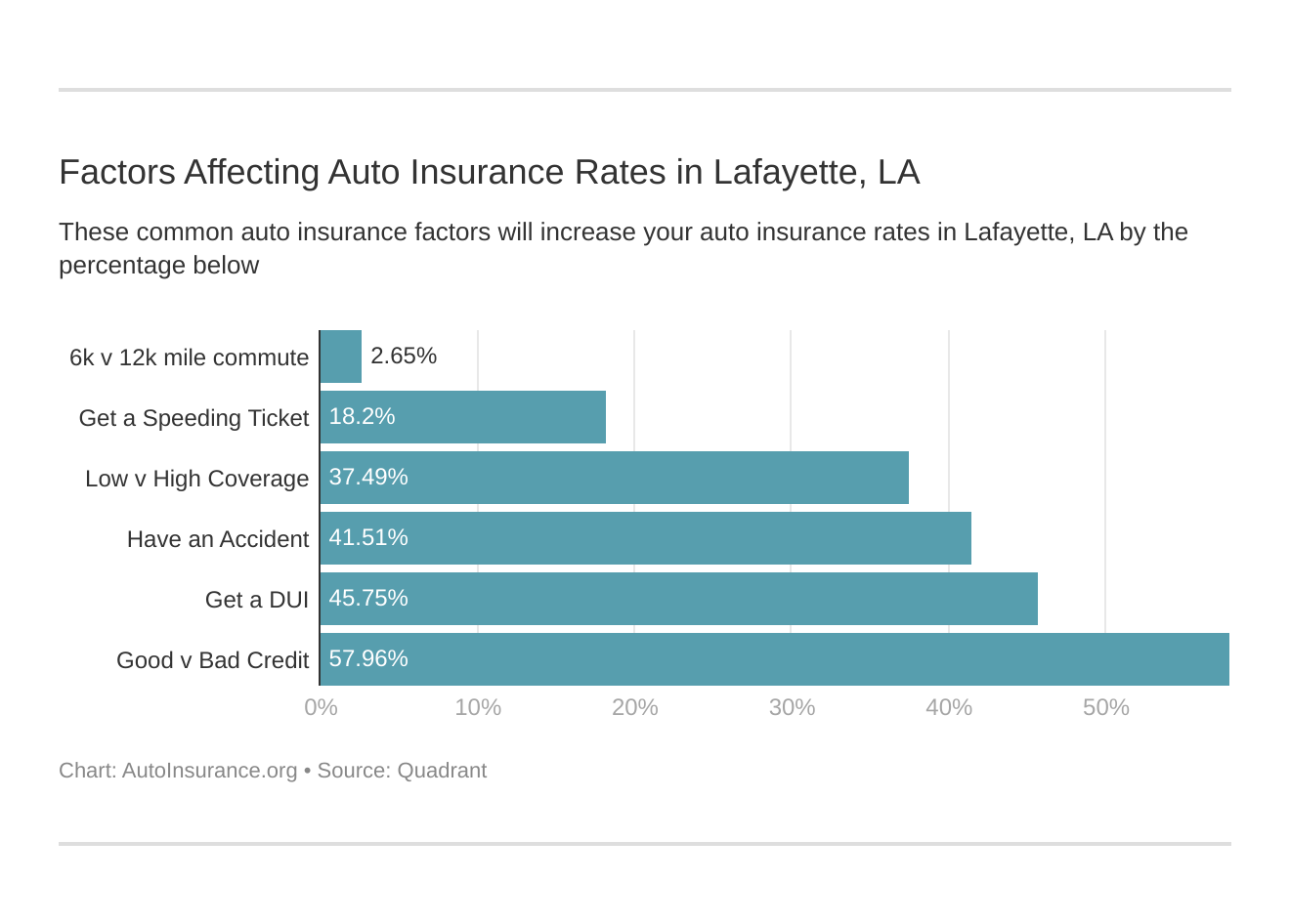

What are the factors that affect car insurance rates in Lafayette?

Together with the factors we explored earlier, the area’s economy, including employment rates, can influence car insurance rates. Among other aspects, we’ll also look at income, education, and poverty levels in Lafayette.

Factors affecting car insurance rates in Lafayette, LA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Lafayette, Louisiana car insurance.

Metro Report – Growth & Prosperity

The Brookings Institution’s Metro Monitor shows the closest metropolitan area to Lafayette, Baton Rouge, ranks 77th out of 100 cities nationwide for economic growth and 78th out of 100 for prosperity.

The economy there is strong, but on average, productivity, wages, and the standard of living rank below the national average, which means that prosperity there is stagnant.

Let’s look more closely at the statistics:

Prosperity

Prosperity captures changes in the average wealth and income an economy produces. When worker productivity contributes to a metropolitan area’s growth through innovation or training, for example, the value of those workers’ labor rises.

This is how the area grew from 2007 to 2017:

- Productivity: +0.5 percent (62nd out of 100)

- Standard of living: +0.8 percent (72nd out of 100)

- Average annual wage: +0.0 percent (92nd out of 100)

Productivity and the standard of living showed small growth, yet the average yearly salary remained stagnant.

Growth

Growth indicators measure the change in the size of an urban area’s economy and its level of entrepreneurial activity. Growth and entrepreneurship create new opportunities for people and can help a metro economy become more efficient.

These figures measure growth in the gross metropolitan product, the number of jobs, and the number of positions at young firms.

Here’s how the Baton Rouge area grew from 2007 to 2017:

- Jobs: +0.1 percent (94th out of 100)

- Gross metropolitan product (GMP): +0.6 percent (87th out of 100)

- Jobs at young firms: +8.3 percent (14th out of 100)

Like the prosperity statistics, growth in jobs, and the GMP — the total market value of the goods and services the local economy produced — was stable in the area. However, jobs at young firms yielded the highest growth rate.

Now, let’s see how the economy drives Lafayette residents’ income, occupation, and level of homeownership.

Median Household Income

According to Data USA, in 2017, Lafayette households had a median annual income of $48,533, which was less than the average annual U.S. income of $60,336. The Lafayette median yearly income showed a 1 percent growth from the previous year.

With the average annual income of $48,533, drivers there pay nearly 11 percent of their wages toward car insurance.

Homeownership in Lafayette

Homeownership shows that a driver may be more reliable and able to pay car insurance premiums. Owning a home affects car insurance i.e. you could pay less for car insurance than if you rent. To save more, homeowners can also bundle their car and home insurance.

Data USA reports that in 2017, 55 percent of the housing units in Lafayette were owner-occupied. This percentage was below the national average of 64 percent.

That same year, the median property value in Lafayette grew to $181,900 from the previous year’s value of $177,100. Most homes in Lafayette were worth $150,000 to $175,000.

Education in Lafayette

In 2016, universities in Lafayette awarded 6,086 degrees. Data USA reveals that the largest universities in Lafayette by the number of degrees awarded are the University of Louisiana at Lafayette (3,386 or 56 percent), South Louisiana Community College (1,661 or 27 percent), and Unitech Training Academy-Lafayette (215 or 4 percent).

The most popular majors in Lafayette are general studies (745 or 12 percent), registered nursing (617 or 10 percent), and medical assistant (225 or 4 percent).

Community colleges, which provide several degrees and certificates in a range of programs, are a lower-cost alternative to traditional schools. South Louisiana Community College offers degrees and certificates in more than 50 programs in some of the most popular fields to 10,000 students annually.

Wage by Race & Ethnicity in Common Jobs

Data USA figures show that in 2017, the highest paid race/ethnicity of Louisiana workers was Asian. These workers were paid only one time more than white workers, who made the second-highest salary of any race/ethnicity.

This chart shows how much of Louisiana’s top three races and ethnicities’ wages pay for car insurance.

Salaries by Ethnicity // % of income - Lafayette, Louisiana

| Race or Ethnicity | Average Salary | Percentage of Income Going to Car Insurance |

|---|---|---|

| Asian | $54,337 | 9.76% |

| White | $51,901 | 10.22% |

| American Indian | $39,423 | 13.46% |

As the highest paid race/ethnicity, nearly 10 percent of Asians’ incomes went to car insurance. Generally, the more a worker earns, the less their income pays for car insurance.

Keep in mind that the cost of the premium listed is an average and might not reflect your experience.

Wage by Gender in Common Jobs

In Louisiana, Data USA has found that in 2017, full-time male employees in Louisiana earn more than females, at an average of $62,488 yearly versus $40,269. Generally, males earned one and a half times more than females.

As a result, females pay 5 percent more of their incomes to car insurance than males, at 13 percent, based on the average annual premium cost of $5,306.56.

Poverty by Age & Gender

According to Data USA numbers, 19 percent of the population for whom poverty status is determined in Lafayette live below the poverty line, which is higher than the national average of 13 percent.

The largest demographic living in poverty are females 18-24, followed by males 18-24 and females 25-34.

The U.S. Census Bureau uses a set of money income thresholds that vary by family size and composition to determine who classifies as impoverished. If a family’s total income falls below their limits, the Census Bureau classifies that family and every family member as living in poverty.

Poverty by Race & Ethnicity

According to Data USA, the most common racial or ethnic group living below the poverty line in Lafayette is black (at 12,383 people), followed by white (9,712) and Hispanic (1,465).

Employment by Occupations

Data USA says that from 2016 to 2017, employment in Lafayette declined at a rate of 0.375 percent.

The most common job groups by the number of people living in Lafayette are sales and related occupations (8,109 people), office and administrative support occupations (7,652 people), and food preparation and serving-related occupations (6,209 people).

What happens if I don’t have car insurance in Lafayette?

When an insured driver is in an accident with an uninsured driver, the injured driver can file a claim under their own uninsured coverage policy. Every car insurance policy issued in Louisiana must include uninsured motorist coverage unless the customer rejects it in writing.

Nolo reports that driving without insurance in Louisiana — or being involved in a crash without insurance — can result in a fine of $500 to $1,000, plus the suspension of driving privileges, vehicle impoundment, revocation of registration, or cancellation of license plates.

Further, the state’s No Pay, No Play law may also prevent you from getting compensation after a car accident in the following amounts, even if the other driver is at fault:

- the first $25,000 in property damages

- the first $15,000 in personal injuries

So it’s better to buy coverage that will protect you from uninsured motorists and exceed the state-required minimums.

How is the driving scene in Lafayette?

Traffic jams and crumbling roads are among the frustrations drivers must deal with.

In this section, we’ll cover the major roadways in Lafayette, pavement conditions, popular American road trips, and traffic laws.

Keep reading to find out more about the hazards of car ownership in the city.

Roads in Lafayette

Lafayette has a fair number of highways in varying conditions. Let’s learn more about them.

Major Highways

Thirteen highways traverse Louisiana and span 934 miles of roadway. The map below shows the major interstates and other highways that run through Lafayette.

These highways include:

- U.S. Route 90

- Louisiana Highway 94

- Interstate 49

The Lafayette Regional Xpressway (LRX) is a transportation improvement project the Lafayette Metropolitan Expressway Commission started in 2004.

Planned as a controlled-access toll road using a new location to connect I-49 north of Lafayette near the city of Carencro, the LRX will also connect I-10 west of Lafayette near the cities of Scott and Duson and U.S. 90 south of Lafayette near Youngsville at U.S. 90.

Major interchanges are proposed at I-49, I-10, U.S. 167/Johnston Street and U.S. 90, with consideration for interchanges with other cross streets. The proposed facility would be four lanes with the potential for expansion to six lanes.

Popular Road Trips/Sites

Lafayette offers several attractions for lovers of fun and adventure to explore. Below are some suggested trips:

- The Acadian Village – This unique village in Cajun country hosts 10 buildings spread over 32 acres that show what 19th-century life was like.

- Acadiana Park Nature Station – This 150-acre recreational area offers the sights and sounds of flora and fauna, with six miles of trails where visitors can enjoy hiking and biking. There’s also a canoe/kayak launch.

- Claude’s Enchanted Village – This Christmas elf village boasts animated displays, live entertainment, local food, and shopping.

Road Conditions

Below are pavement conditions and vehicle operating costs in Lafayette from the National Transportation Research Group (TRIP), a national transportation research group:

Road Conditions - Lafayette, Louisiana

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 40% | 24% | 16% | 21% | $765 |

Most roads there are in poor shape, which means road safety conditions are an issue. Vehicle operating costs (VOC) can include repairs from driving over potholes or road debris along the highway.

Does Lafayette use speeding or red light cameras?

According to the Insurance Institute for Highway Safety, Lafayette has speeding cameras but doesn’t use red-light cameras at its intersections.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What type of vehicles can be found in Lafayette?

Below, we’ll cover the most popular cars owned in the area, car ownership, and crime rates (including vehicle thefts).

Most Popular Vehicles Owned

YourMechanic tracks the types of vehicles it services nationwide and breaks down the information by each major city to show Americans’ car preferences.

According to their survey, 50 percent of the cars they repair in Baton Rouge (about an hour away from Lafayette) are American-made. The Honda Accord is the most popular make and model.

Consumer Reports gives the 2020 Honda Accord an 82 out of 100, reporting that “Honda took a big gamble with its wholesale overhaul of the popular Accord midsized sedan. The redesign includes the addition of new turbocharged engines, an available hybrid powertrain, comprehensive changes to the control layout, and standard crash-avoidance features, all wrapped in an attractive, coupe-like body.”

It also noted that the Accord is “one of the quickest cars in its class, yet it averages an excellent 31 mpg overall, a one-mpg improvement over the previous Accord four-cylinder.”

For safety, the car received a good rating from the IIHS, and the National Traffic Highway Safety Administration gave it five stars.

How Many Cars Per Household

Data USA has found that most Lafayette households own two cars, followed by one car. With two-car ownership at 48 percent, it’s slightly higher than the national average of 42 percent.

Households Without a Car

The table below reveals how many Lafayette households on average own and don’t own cars.

Households Without a Car - Lafayette, Louisiana

| 2015 Households Without Vehicles (%) | 2016 Households Without Vehicles (%) | 2017 Households Without Vehicles (%) | 2018 Households Without Vehicles (%) | 2019 Households Without Vehicles (%) | 2020 Households Without Vehicles (%) | 2021 Households Without Vehicles (%) | 2022 Households Without Vehicles (%) | 2015 Vehicles Per Household | 2016 Vehicles Per Household | 2017 Vehicles Per Household | 2018 Vehicles Per Household | 2019 Vehicles Per Household | 2020 Vehicles Per Household | 2021 Vehicles Per Household | 2022 Vehicles Per Household |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10.60% | 8.00% | 8.20% | 8.50% | 8.30% | 8.10% | 8.00% | 7.80% | 1.6 | 1.6 | 1.6 | 1.6 | 1.7 | 1.7 | 1.7 | 1.7 |

Though the percentage of car ownership increased from 2015 to 2016 by nearly 3 percent, the number of cars owned stayed the same, at about 2 percent.

Speed Traps in Lafayette

Speedtrap.org keeps track of speed traps all across the United States, as ranked by its users. Among the Lafayette roads visitors have debated are truly speed traps, the following received the most votes:

- Johnson Street near South Collage Drive

- On Settlers Trace between Beaullieu and Ambassador

- West Bluebird Street behind Comeaux High School (Student Lane)

- South Ambassador Caffery Parkway approaching Verot School Road

- Just north of Lafayette (about three miles) on I-49

If you’re in those areas, it makes sense to obey speed limits to avoid worrying about speed traps and potential penalties. And best of all, you’ll help keep yourself and others safe.

Vehicle Theft in Lafayette

The Federal Bureau of Investigation (FBI) reports that in 2017, 297 vehicle thefts occurred in Lafayette.

Neighborhood Scout also tracks crime statistics for U.S. cities. Below is their map of the safest districts in Lafayette, which includes the neighborhood of Milton.

The site gives the city a crime index of 3, which means it’s 3 percent safer than other U.S. cities. In Lafayette, your chances of being a victim of violent crime are one in 182. Statewide, however, they decrease slightly to one in 186. In the city and across the state, these chances are fairly high.

For property crimes, those chances are lower, at one in 21 in Lafayette and one in 31 in Louisiana as a whole.

Per square mile in Lafayette, an average of 137 crimes occur, which is four times the rate statewide, which is 34. Nationally, the average is 31 crimes per square mile.

For a closer look at the crimes that occur in Lafayette, below is a chart showing figures from 2017:

Lafayette, Louisiana Annual Crimes

| Lafayette Annual Crimes | VIOLENT | PROPERTY | TOTAL |

|---|---|---|---|

| Number of crimes | 740 | 6065 | 6805 |

| Crime rate (per 1,000 residents) | 5.83 | 47.81 | 53.65 |

Overall, more property crimes occurred than violent crimes.

What is traffic like in Lafayette?

Car insurers also explore traffic patterns in an area to see how congested they are. The more cars are on the road, the more accidents will happen.

Below, we’ll cover traffic congestion in Lafayette, the busiest highways, and the safety of its streets and roads.

Traffic Congestion in Lafayette

Lafayette didn’t make it onto any major traffic monitoring studies’ results for congestion. According to the TomTom Traffic Index, the closest city, Baton Rouge, ranks 169th worldwide for its traffic congestion. For every 30 minutes of travel, during peak travel times in the morning, commuters face an extra 10 minutes in traffic, and in the evening, the time doubles to 20 minutes.

In the morning, 34 percent of traffic is congested, and in the evening, that percentage rises to 66. On highways there, the congestion level reaches 21 percent, and on non-highways, 28 percent.

Transportation

Commuters in Lafayette have, on average, a shorter commute (20.4 minutes) than the average U.S. worker (25.1 minutes). Additionally, 3.5 percent of the workforce in Lafayette faces a commute longer than 90 minutes.

Data USA reports that in 2017, most commuters — 82 percent — drove alone, followed by those who carpooled (9 percent).

Busiest Highways

This map shows current local traffic conditions and which highways are the most active. U.S. Route 167, for instance, appears as one of the most congested roadways in the area.

How safe are Lafayette’s streets & roads?

In this section, you’ll find out how many fatal accidents happened in Lafayette Parish, courtesy of the National Highway Traffic Safety Administration (NHTSA). We’ll cover everything from the total fatalities by county to vehicle and railroad accidents.

Below are the total crash deaths by county in 2018:

- Fatalities (all crashes) = 18 total

- Fatalities in crashes involving an alcohol-impaired driver (BAC = .08+) = 6

- Single-vehicle crash fatalities = 9

- Fatalities in crashes involving speeding = 3

- Fatalities in crashes involving a roadway departure = 7

- Fatalities in crashes Involving an intersection (or intersection-related) = 6

- Passenger car occupant fatalities = 5

- Pedestrian fatalities = 5

- Pedal cyclist fatalities = 1

Most of the crashes involved single vehicles and roadway departures.

Next, the figures below show the fatalities by road type and function class in Louisiana.

Crash Fatalities by State Road Function Class (Louisiana)

| INTERSTATE (RURAL) | INTERSTATE (URBAN) | FREEWAY AND EXPRESSWAY | OTHER PRINCIPAL ARTERIAL | MINOR ARTERIAL | COLLECTOR ARTERIAL | LOCAL | UNKNOWN | TOTAL FATAL CRASHES |

|---|---|---|---|---|---|---|---|---|

| 40 | 65 | 9 | 146 | 150 | 165 | 119 | 2 | 696 |

Most of the crashes occurred on arterial roads. An arterial road is a high-capacity urban road. Depending on the amount of traffic, the arterial road may be classified as a highway or a minor arterial road. A collector road gathers traffic from local roads and takes drivers to arterial roads.

Based on U.S. Department of Transportation (DOT) data, the table below shows the number of railroad and highway crash incidents that happened in Lafayette from 2012 to 2016:

Railroad Crash Incidents - Lafayette, Louisiana

| Calendar Year | County | Highway | Highway User Type | Rail Equipment Type | nonsuicidefatality | nonsuicideinjury | City |

|---|---|---|---|---|---|---|---|

| 2013 | LAFAYETTE | WEST LOOP ST. | Pedestrian | Psgr Train | 1 | 0 | LAFAYETTE |

| 2014 | LAFAYETTE | REFINERY ST | Van | Freight Train | 0 | 1 | LAFAYETTE |

| 2015 | LAFAYETTE | E. THIRD ST | Pedestrian | Freight Train | 1 | 0 | LAFAYETTE |

| 2015 | LAFAYETTE | PINHOOK RD. | Automobile | Psgr Train | 0 | 1 | LAFAYETTE |

| 2016 | LAFAYETTE | VEROT SCHOOL ROAD | Automobile | Freight Train | 0 | 0 | LAFAYETTE |

| 2016 | LAFAYETTE | MUDD ST | Automobile | Freight Train | 0 | 1 | LAFAYETTE |

| 2016 | TIPPECANOE | CR 39/9TH ST | Automobile | Freight Train | 0 | 0 | LAFAYETTE |

Several accidents occurred in Lafayette, including two that involved pedestrians.

Allstate America’s Best Drivers Report

Allstate America’s Best Drivers Report tracks the numbers of accident claims drivers make nationwide. According to Allstate claims data, the average driver in the U.S. will experience a collision once every 10.57 years.

In 2019, the nearby city of Baton Rouge ranked 188th out of 200 major cities on the report, down from 185th the prior year. The chart below shows residents’ insurance claim statistics.

Allstate America's Best Drivers Report - Baton Rouge, Louisiana

| Average Years Between Collisions | 2024 Best Drivers Report Ranking | Change in Ranking from 2023 to 2024 | Relative Claim Likelihood (Compared to National Average) | Drivewise® Hard-Braking Events per 1,000 Miles |

|---|---|---|---|---|

| 6.1 | 188 | -2 | 0.58 | 27.5 |

Drivers in Baton Rouge went an average of seven years between accident claims, and they were nearly 55 percent more likely to file a claim compared to the national average.

Compared to other cities nationwide, Baton Rouge drivers file more claims more often, and that shows in the city’s ranking on the report.

Ridesharing

Below are the ridesharing services available in Lafayette beyond regular taxi rides.

- Lyft – This lowest cost Lyft service will grant you a request for a regular four-seat car.

- Lyft Plus – This is the best Lyft option for larger groups. A Lyft Plus car can seat six or more passengers. Fare prices tend to run higher than a regular Lyft ride to compensate van and SUV drivers for their higher vehicle running costs.

- Uber X – This budget service gives riders a regular-size car that seats four.

- Uber XL – Uber’s service for larger groups will seat up to six passengers.

E-star Repair Shops

A program from Esurance, E-star helps drivers find the best repair shops in their areas. According to E-star, these are the top repair shops in and around Lafayette:

Gerber – Lafayette/Verot School Rd.

1555 Verot School Rd.

Lafayette, LA 70508

Email: gerberlaaudits@gerbercollision.com

Phone: (337) 317-8200

Fax: (337) 465-2301

Louisiana Auto Collision – Lafayette

900 E. Simcoe St.

Lafayette, LA 70501

Email: monique@laautocollision.com

Phone: (337) 233-6411

When your car needs repair, check out E-star shops to ensure you get quality service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What is the weather like in Lafayette?

U.S. Climate Data reveals the average temperature in Lafayette is 69 degrees. The city receives a moderate amount of rainfall yearly.

Weather - Lafayette, Louisiana

| Lafayette weather averages | |

|---|---|

| Annual high temperature: | 78.8°F |

| Annual low temperature: | 59.6°F |

| Average temperature: | 69.2°F |

| Average annual precipitation - rainfall: | 60.48 inch |

City-Data shows that Lafayette Parish averages 20 natural disasters yearly, which is higher than the U.S. average of 13. Every year, an average of four natural disasters lead to emergency declarations and 16 are presidential declarations.

Below is a breakdown of the causes of disasters. Note: some incidents may be assigned to more than one category.

- Hurricanes: 10

- Floods: 6

- Storms: 6

- Tropical storms: 2

- Drought: 1

- Freeze: 1

Most of the natural disasters that hit Lafayette involve hurricanes and storms, which may lead to floods.

Given the risks involved, it makes sense to buy comprehensive car insurance for protection from floods, storms, and other hazards that can damage your vehicle.

Are there public transit options in Lafayette?

Whether you need to get around the city or travel a long distance, you’ll find plenty of public transit options in Lafayette that include bus and rail service.

The Lafayette Transit System (LTS) offers bus service in metropolitan Lafayette. Twelve routes run Monday-Saturday, usually at half-hour or hourly intervals.

During the late evening and late-night hours, buses keep running, with four routes covering specific zones of the city. All LTS buses are low-floor and handicapped accessible, and each one carries a bike rack.

Basic fares:

- Adult: $1

- Child ages 5-12: 90 cents

- Disabled, seniors, and Medicare recipients: 50 cents

- Child age 5 (with adult): free

- Da Pass: $3

Amtrak passenger rail service is also available in Lafayette.

Are there alternate transportation methods?

Major bike and scooter rental companies, such as Lime and Bird, don’t operate in Lafayette. The city, however, recognizes the need for dedicated bike paths and rentals and has included them in its comprehensive growth plan.

Parking in Metro Areas

Several parking lots and garages are available throughout Lafayette, including metered street-level parking.

ChargeHub lists the most popular electric car charging stations within 10 miles of Lafayette. Some of them are free. Most of them are Level 2; however, some Level 3 charging stations are also available. The main charging network is ChargePoint.

Air Quality in Lafayette

Pollution from vehicle exhaust has been linked to health issues and even climate change. The pollution not only goes directly into the earth’s atmosphere, but it also reacts with other pollutants, which makes the situation worse.

Children and people with chronic illnesses can be most sensitive to the effects.

Below are the Environmental Protection Agency (EPA) air quality levels for Lafayette Parish from 2016 to 2018.

Air Quality (Lafayette Parish) - Lafayette, Louisiana

| Lafayette Air Quality Index (AQI) | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|

| Days with AQI | 366 | 365 | 365 | 365 | 366 | 365 | 365 |

| Days Good | 292 | 269 | 269 | 265 | 258 | 252 | 250 |

| Days Moderate | 74 | 95 | 96 | 98 | 103 | 110 | 112 |

| Days Unhealthy for Sensitive Groups | 0 | 1 | 0 | 2 | 5 | 3 | 3 |

| Days Unhealthy | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Days Very Unhealthy | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

The Air Quality Index (AQI) measurements remained consistent during those three years, and days unhealthy for sensitive groups were, fortunately, rare.

In Louisiana, certain vehicles registered in the five-parish Baton Rouge ozone non-attainment area (Ascension, East Baton Rouge, Iberville, Livingston, and West Baton Rouge parishes) must undergo emissions tests.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What are the choices for the military and veterans?

With the many choices available, past and present members of the armed forces may find it hard to find decent discounts on car insurance. Even if you find one, it might not apply to your situation.

There’s no need to worry. This section includes information about military discounts, together with facts about when local veterans served and nearby military bases.

Keep reading to learn some exciting facts about Lafayette’s military and veterans and the car insurance savings available to them.

Veterans by Service Period

Data USA stats show that most of Lafayette’s veterans served in Vietnam, which was nearly two times more than any other conflict. Recent Gulf War veterans placed a distant second. These numbers match the national figures.

Military Bases Within an Hour

No military bases are located within an hour of Lafayette.

Military Discounts by Providers

If you are or were in the U.S. military, most car insurance companies will want to give back by serving you. Many of them offer cheap auto insurance for military members.

Below is a list of known providers who give military discounts. We excluded those who offer military discounts only in certain states.

Military Auto Insurance Discounts

| Insurance Company | Savings Amount |

|---|---|

| 5% | |

| 15% | |

| 4% |

| 15% | |

| 60% off when deployed 15% for garaging on base |

*USAA gives a 15 percent military discount for garaging cars on a military base.

USAA Availability in Louisiana

USAA provides car insurance only to U.S. military personnel and their families. The company’s insurance premiums tend to cost less than those of standard insurers.

Below, you’ll see how USAA’s and other insurers’ rates compare to the cost of average annual full coverage premiums in Louisiana.

USAA in Louisiana

| GROUP | ANNUAL PREMIUM | COMPARED TO STATE AVERAGE (+/-) | COMPARED TO STATE AVERAGE (%) |

|---|---|---|---|

| $5,998.79 | $287.45 | 5.03% | |

| $6,154.60 | $443.25 | 7.76% | |

| $7,471.10 | $1,759.76 | 30.81% | |

| $4,579.12 | -$1,132.22 | -19.82% | |

| $4,353.12 | -$1,358.23 | -23.78% |

Compared to other top insurance carriers, USAA offered the lowest rates statewide.

What are some unique city laws?

Every city has laws, but no two cities share the same laws. So if you move to another town, you may have to adjust to new regulations.

Below, we’ll go over laws unique to Lafayette, from hands-free laws to food trucks, tiny homes, and parking regulations.

So, read on to catch up on some local laws.

Hands-Free Laws

Louisiana bans the use of handheld devices in designated school zones. Holders of learner’s permits and intermediate licenses can’t use handheld cellphones while they drive.

These laws are primary enforcement, which means a police officer can pull you over and ticket you for committing the offense.

Drivers younger than 18 can’t use handheld devices, nor can all drivers during their first year with a full license. This law falls under secondary enforcement. So an officer would need to pull you over for another infraction, such as a burned-out headlight before they cite you for handheld use.

Food Trucks

Lafayette allows food trucks to run in the city and has certain rules regarding their operation. Before you set up shop, make sure you follow local regulations.

Tiny Homes

Tiny homes appeal to people who want to simplify their lives. Before you abandon standard housing, you should be aware that tiny homes have specific regulations.

A tiny house is usually considered a mobile home and must follow the same laws. Lafayette has several laws regarding mobile and modular homes of different sizes.

Parking Laws

In Lafayette, a vehicle parked in a metered zone must be parked with the front bumper of the car next to the parking meter. In parallel parking spaces, the vehicle must be alongside a parking space, and in diagonal parking spaces, the center and front of the car must face the meter.

As for reserved parking for the handicapped, appropriate parking spaces have been designated throughout the city.

Compare Lafayette, Louisiana Auto Insurance Quotes

Before you buy Lafayette, Louisiana auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Lafayette, Louisiana auto insurance quotes.

Frequently Asked Questions

Is auto insurance mandatory in Lafayette, LA?

Yes, auto insurance is mandatory in Lafayette, LA, as it is in the state of Louisiana. All drivers in Lafayette must carry at least the minimum required liability insurance as mandated by state law.

What are the minimum auto insurance requirements in Lafayette, LA?

In Lafayette, LA, drivers are required to carry liability insurance with minimum coverage limits of 15/30/25. This means at least $15,000 bodily injury liability coverage per person, $30,000 bodily injury liability coverage per accident, and $25,000 property damage liability coverage per accident.

Are there any additional coverage options to consider for auto insurance in Lafayette, LA?

While liability insurance is the minimum requirement, it’s also important to consider additional coverage options for enhanced protection. Collision coverage can help cover repairs or replacement costs for your vehicle in case of a collision. Comprehensive coverage can protect against non-collision-related incidents such as theft, vandalism, or damage from natural disasters. Uninsured/underinsured motorist coverage is also recommended to protect you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

How can I find affordable auto insurance in Lafayette, LA?

To find affordable auto insurance in Lafayette, LA, it’s advisable to shop around and compare quotes from different insurance providers. Factors such as your driving record, age, type of vehicle, and coverage needs can influence the cost of insurance. Additionally, maintaining a good driving record, bundling your auto insurance with other policies, and inquiring about available discounts can help you secure more affordable rates.

Are there any specific discounts or programs available for auto insurance in Lafayette, LA?

Insurance providers may offer various discounts and programs that can help reduce the cost of auto insurance in Lafayette, LA. These may include discounts for safe driving, good student discounts, multi-policy discounts, or discounts for installing safety features in your vehicle. It’s recommended to inquire about available discounts when obtaining insurance quotes.

What should I do if I need to file an auto insurance claim in Lafayette, LA?

If you need to file an auto insurance claim in Lafayette, LA, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on what information or documentation is required. Be prepared to provide details about the incident, such as the date, time, location, and any necessary supporting evidence, such as photographs or police reports.

Can I use my Lafayette, LA auto insurance for out-of-state travel?

Your Lafayette, LA auto insurance typically provides coverage when you travel out of state. However, it’s important to review your policy or contact your insurance provider to understand any limitations or restrictions that may apply. Some policies may have certain coverage limitations or additional requirements when driving in certain states or regions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.